Table of Contents

The eCommerce sector is leading the way in innovation in a world where technology is reshaping how we do business.

Given how common online purchasing is, it should come as no surprise that online payments have become the newest and most prominent thing in the eCommerce world.

The emergence of digital payments is changing the face of eCommerce by providing sellers with new opportunities as well as obstacles.

Your success as a vendor depends on more than just the caliber of your products in the cutthroat world of online shopping; convenience and security of the payment process are frequently critical factors.

With an emphasis on the eCommerce industry, we examine the leading digital payment trends for 2024 and beyond in this blog post.

These insights are crucial for sellers hoping to prosper in the dynamic world of digital commerce. Let’s explore how online payments are changing the face of commerce and their revolutionary potential.

eCommerce Payment Solutions Trends

The 2019 epidemic expedited the digital revolution. It altered the payment methods that customers feel comfortable utilizing and how companies receive payments. It put fuel in the payments’ future.

The coronavirus pandemic pushed consumers and companies to rely more on contactless and digital payment methods as breakthrough cases became more common.

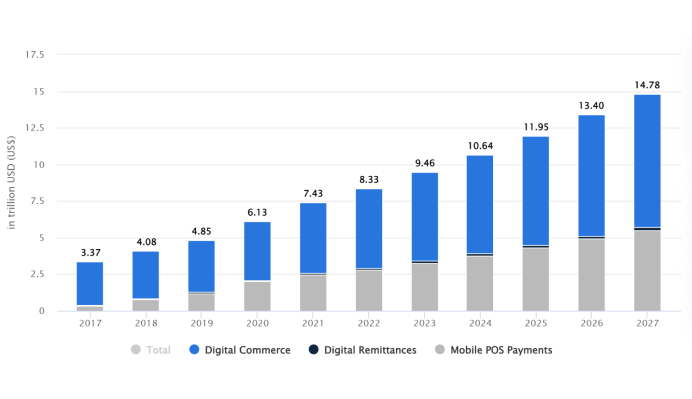

The overall transaction value in the digital payments market is expected to reach €6,367,356 million in 2022, according to Statista. By 2027, it is anticipated to have grown at a pace of 11.58% per year.

Below are some of the eCommerce payment solutions trends:

1. Contactless Payments

Due to their convenience and added security, contactless payments have become more popular, particularly during the COVID-19 pandemic.

This payment option is probably going to grow in popularity and play a bigger role in the landscape of eCommerce payment solutions.

The quick, secure, and safe payment option known as contactless is here to stay. Particularly as more individuals use their smartphones to make payments and as contactless transaction limitations rise.

Social distancing efforts during the pandemic contributed to the growth of contactless payments. However, as consumer behavior shifts, more individuals become aware of how simple mobile payments are. The usage of digital wallets will increase, and the use of credit cards will decrease.

With the advent of mobile self-checkout, customers may now avoid long lineups and maintain a safe physical distance from one another. The point of sale (POS) will be moved by retailers from a fixed physical location to a mobile one.

Large retailers aren’t the ones using software-based point-of-sale equipment as demand for it rises. Customers of smaller companies are also able to use this new payment option.

2. Bank accounts as a commodity

Banks have also utilized customer accounts to promote their goods and cultivate customer loyalty.

We are approaching a period when bank accounts will become commodities due to tech firms like Google entering the banking space and providing current accounts.

Providing methods for clients to pay and save money through accounts is more about giving them additional benefits than it is about accepting payments. Platforms offer clients a more convenient experience, expand their product range, and personalize their approach.

3. Cryptocurrency Payments

Cryptocurrencies, such as Ethereum and Bitcoin, are advancing toward becoming the payment processors of the future for online retailers. They have the potential to offer a decentralized, affordable, and safe payment option as a rising trend.

Due to their volatility, cryptocurrencies have not yet gained universal acceptance among customers and retailers, but interest and acceptance are growing as their advantages become more clear.

Cryptocurrencies have yet to attain mainstream adoption in the eCommerce space but represent a substantial opportunity for innovation, notably in the field of fiat conversion platforms (C2F).

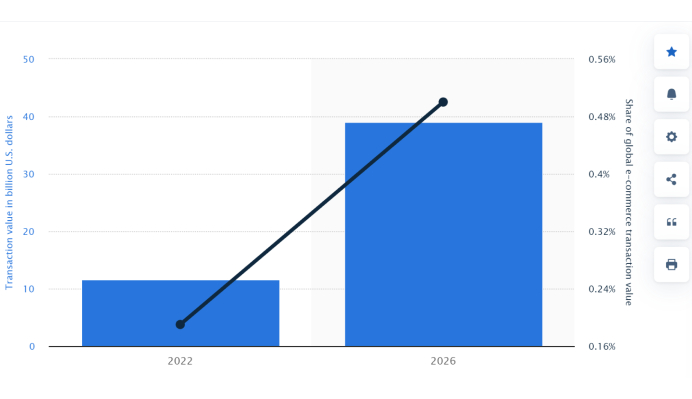

According to Market research, the market for cryptocurrencies as a B2C method will rise between 2022 and 2026, accounting for less than 0.5 percent of worldwide eCommerce transaction value.

The growth rate of cryptocurrency transactions using payment gateways is projected to be approximately 17% CAGR from 2022 to 2029. In 2022, mobile data overtook apparel and electronics as the most popular goods to be purchased with cryptocurrency.

However, estimates suggest that this amount is about to increase significantly, with Bitcoin payments predicted to reach about $39 billion by 2026—or just less than 0.5% of the value of all .

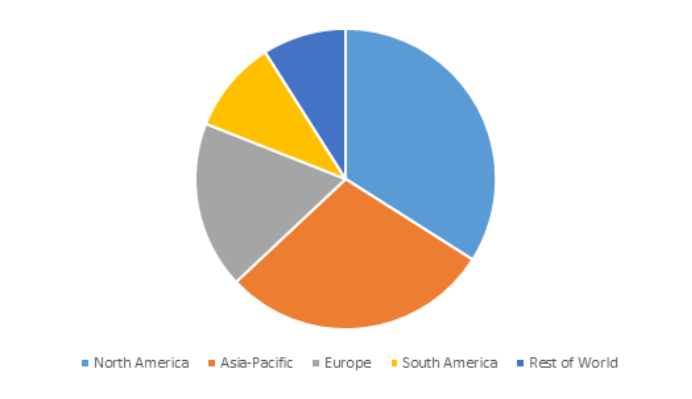

Because Bitcoin was accepted as a form of payment earlier than other currencies, North America is predicted to hold the most significant percentage in 2020.

Peer-to-business (P2B) payments using cryptocurrencies have a lot of potential, especially as more approachable and user-friendly crypto solutions are created.

4. Digital Wallets

The explosive growth of digital wallets is one of the most prominent developments in eCommerce payments. Companies like Apple Pay, PayPal, and Alipay have collected a staggering US$18 trillion in sales, accounting for 32% of the point of sale (POS) and 49% of the eCommerce market.

This dominance indicates a substantial shift in customer preferences in favor of these safe and practical digital payment options. The proliferation of digital wallets is similarly noteworthy in Latin America (LATAM).

Digital wallets are predicted to account for 28% of transaction value in 2026, up from 21% in 2022. At the same time, point of sale (POS) will see a rise from 15% to 24%.

The digital wallet market is very competitive, with a wide range of participants, including fintechs, banks, neobanks, super applications, and device manufacturers. This forces retailers in every consumer-facing segment to accept wallets.

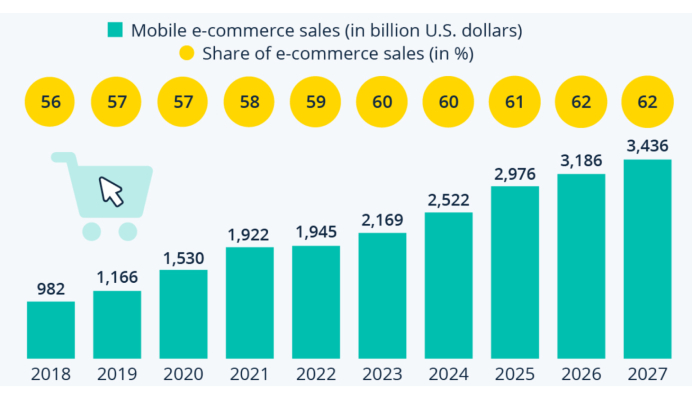

The percentage of overall mobile eCommerce has been steadily increasing, from just 56% in 2018 to a projected 62% in 2027. The rise in mobile eCommerce sales has been more pronounced as the industry as a whole continues to grow worldwide.

Analysts at Statista predict that mobile eCommerce will bring in $3.4 trillion in sales by 2027, a significant increase from the $982 billion recorded in the same category in 2018.

5. Buy Now, Pay Later (BNPL)

A common payment method used by customers who wish to divide the expense of purchase into smaller, more manageable installments is buy now, pay later. However, this payment option is currently evolving with the rise of crypto payments.

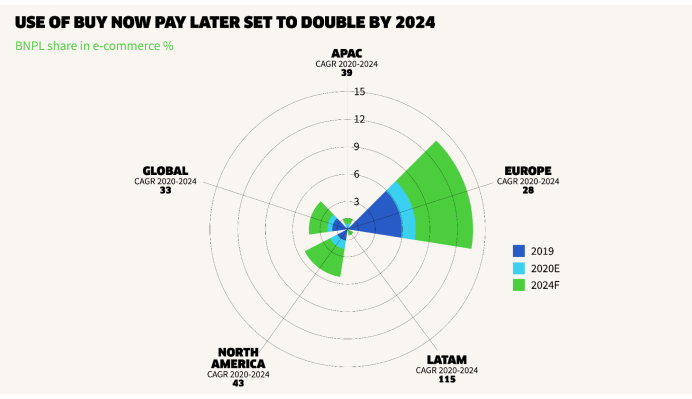

BNPL will be used for $306.8 billion in eCommerce purchases by 2024, up from $97.2 billion in 2020. The rationale is that more customers are selecting buy now pay later (BNPL) as a means of controlling costs and creating budgets by handling purchases right at the point of sale.

The BNPL trend will continue to spread into additional verticals throughout the next ten years, contingent on the effects of various legislation.

Similarly, BNPL brands, like Klarna, which recently entered the German retail banking market, can leverage their strong customer loyalty and brand equity to go into other financial services sectors.

6. A2A Payments

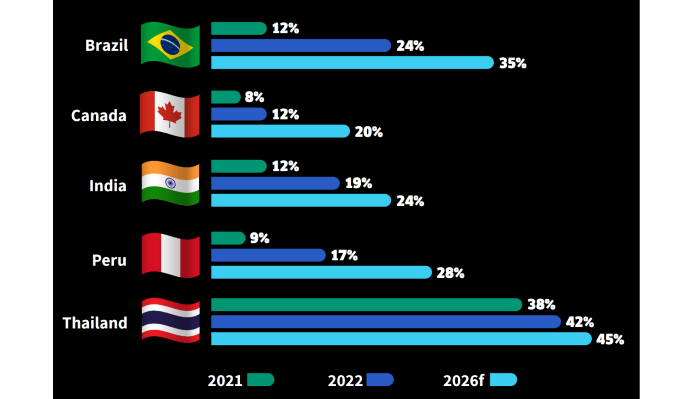

Real-time payment (RTP) rails coupled with account-to-account (A2A) payments are expected to revolutionize the industry and develop at a strong 13% CAGR worldwide through 2026.

A2A payments made using RTP rails provide businesses with unmatched speed, economy, and quick “settlement”—that is, businesses will experience instant receipt of receivables. Traditional payment value chains are seriously threatened by this new payment technique.

Brazil’s adoption of PIX, which witnessed a twofold increase in A2A’s share of eCommerce transaction volume in just one year, mostly driven by person-to-business (P2B) transactions, serves as an exemplary case of A2A’s potential.

A2A payments improve business cash flow by lowering acceptance fees and providing instant access to funds.

7. Cross-Border Payments

By 2025, the cross-border eCommerce market is projected to have grown at a compound annual growth rate (CAGR) of 17.4%. This statistic implies that it’s time to update if you’re not ready to take overseas payments.

Transactions involving businesses, people, or banks located in at least two separate nations—that may or may not share a border—are referred to as cross-border payments.

A transaction involving multiple countries is more likely to include different currencies, necessitating foreign currency exchange to finish the transaction. Fintech companies and payment service providers (PSPs) are involved in this.

Finding a payment solution that facilitates cross-border payments and lowers or eliminates exchange rates to make these transactions more affordable and seamless is crucial if you want to accept cross-border payments.

8. Artificial Intelligence and Machine Learning

Personalized shopping experiences are being made possible by the use of AI and machine learning technologies. These technologies are being used by eCommerce platforms to analyze the preferences and behavior of their customers.

Payment gateways are being transformed by AI and ML thanks to the implementation of clever features like fraud detection and risk assessment. AI can identify trends and odd activity by evaluating large amounts of transaction data, which aids in the fight against fraud.

With each new set of data, machine learning algorithms improve in precision. As a result, transaction procedures become safer and more effective, lowering risks for both customers and businesses.

9. Voice Payments

The future of eCommerce payment systems is predicted to be impacted by voice commerce, or v-commerce, a growing trend. Alexa from Amazon and Google Assistant are two examples of technologies allowing users to purchase with voice commands.

These devices allow users to perform a wide range of tasks with voice commands. These consist of adding goods to carts, paying, and product searching. Voice-activated payments are going to be more important in eCommerce as this technology advances and gets more commonly used.

Voice payment has also been demonstrated to enhance the clientele’s experience. Customers can ask their virtual assistant to finish a transaction for them instead of having to go through convoluted menus. This minimizes the possibility of mistakes being made throughout the transaction, in addition to expediting the checkout process.

10. Central Bank Digital Currencies(CBDC)

Digital currency produced and guaranteed by a central bank is known as central bank digital currency.

It is the digital equivalent of the nation’s fiat currency, meaning that rather than creating banknotes, the central bank manages coins or accounts that are fully guaranteed by the government.

Central banks all across the world have accepted that they must use digital currencies or risk falling behind as the acceptability of cryptocurrencies and stablecoins grows.

When compared to real currency, CBDCs are more economical due to their reduced transaction costs. Financial inclusion is promoted by providing safe and convenient access to money via phones for those without bank accounts.

Monetary policy can operate more quickly and smoothly. By pressuring private businesses to be more open and to cut down on illegal activity, CBDCs compete with them.

By enabling direct trading through the same data, technical standards, and compliance criteria, CBDCs can facilitate better cross-border payments than those that go through a convoluted, sluggish, and difficult-to-access payment chain.

Benefits of eCommerce Payment Solutions

Although eCommerce has completely changed the way we buy, making payments is still an essential aspect of the process.

Payment options that are easy to use, safe, and effective are becoming more and more crucial as more people shop online. In an age of perpetual change, accepting change has become essential to success.

The field of eCommerce payment solutions is developing at an impressive rate at this time, driven by changes in consumer behavior, technology breakthroughs, and a global economy that is becoming more and more digital. Below are some of the advantages of eCommerce payment solutions.

1. Secure Transactions

The security of their financial information is one of the main worries of consumers when they shop online. In response to this worry, online payment systems have put strong security measures in place.

Online payments are now safer than ever thanks to sophisticated encryption technology and reliable payment gateways that safeguard sensitive consumer information.

Given that their credit card information is protected from any dangers, customers can submit it with confidence. Customers now have more faith in online payment systems because of this increased security, which is fueling the expansion of eCommerce.

2. Worldwide Availability

Geographical limitations are eliminated with online payments. When using traditional payment methods, companies are frequently limited to serving local customers. Nonetheless, platforms for eCommerce can now serve a worldwide customer base.

Due to the widespread acceptance of online payment methods like credit cards and digital wallets, firms can reach a global clientele and grow their business.

3. A Benefit to Small Companies

Not only can online payments help the big players in eCommerce, but they are also essential to small enterprises. Smaller businesses don’t need as much infrastructure because they can easily accept payments online and create an online presence.

This accessibility opens up opportunities for local enterprises to compete globally, adding to the eCommerce landscape’s diversity.

4. Quick Transactions

Everyone wants to avoid having to wait a long time for their transactions to be processed in our fast-paced environment. Customers can finish their purchases in a matter of seconds thanks to the blazingly fast transaction speeds offered by online payments.

The entire buying experience is improved by this rapid and effective process, which is crucial for the success of eCommerce. Enhancing the customer experience depends on transaction processing speed.

Time-saving transaction times are the goal of new developments in payment gateway extensions.

Features like fast payments and real-time processing not only boost transaction efficiency but also give immediate confirmation to clients, which is vital for their happiness and in reducing cart abandonment.

5. The Online Payments Convenience

In the digital age, online payments have completely changed how we conduct business. They give clients a convenient and effective option to shop from the comfort of their homes. Online payments make purchasing food, apparel, electronics, and even booking services incredibly convenient.

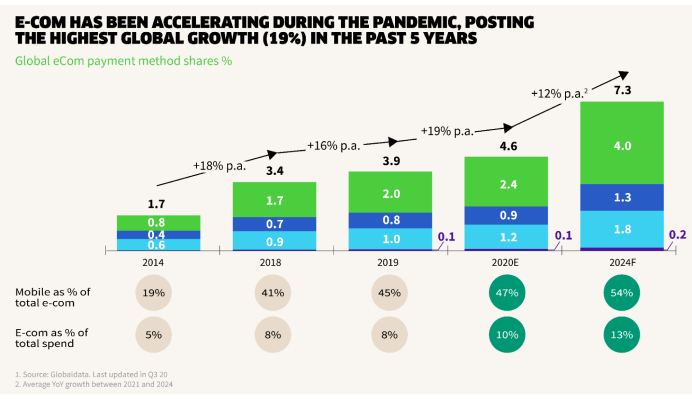

With the most growth in the previous five years, the global eCommerce market expanded by 19% to reach $4.6 trillion in 2018. These statistics imply that there will be a nearly three-year acceleration in a single year.

The eCommerce market is expected to reach $7.3 trillion globally by 2024, with a further 60% growth predicted, mostly due to mobile shopping via social media and applications.

Customers may safely conduct their transactions with a few clicks, doing away with the need to deal with actual cash or visit physical businesses. eCommerce companies have flourished greatly as a result of this convenience.

Conclusion

Advances in technology and changing consumer preferences will bring about significant changes in the future of eCommerce payments.

Alternative payment options, including cryptocurrency, purchase now, pay later services, and mobile wallets, are becoming increasingly popular. The environment is also being shaped by the possibility of digital currencies issued by central banks and real-time payments.

Businesses must adapt, incorporate cutting-edge payment methods, and give priority to secure and frictionless experiences if they want to prosper in this fast-paced world.

With developments like blockchain and artificial intelligence, the future offers improved transaction speeds, security, and user experiences.

You may take advantage of development prospects and thrive in the dynamic digital economy.

Acowebs are the developers of WooCommerce checkout field editor plugin which helps to manage the checkout page fields in your WooCommerce Store. woocommerce checkout field‘s drag and drop form builder helps editing checkout fields easier. It can be used to modify or hide default woocommerce checkout fields.

Login

Login

Cart

Cart