As an eCommerce business owner, you’re always on the lookout for new ways to improve your customers’ shopping experience and increase conversions. One of the latest digital payment trends you don’t want to miss out on is the use of digital wallets.

These wallets are essentially virtual versions of physical wallets, and they store a customer’s payment information, such as credit cards, debit cards, and rewards cards, making the online payment process much more convenient and hassle-free.

With popular options like PayPal, Google Pay, Apple Pay, and Venmo, customers can now complete their online purchases with just a few taps on their mobile devices without manually entering their payment details every time.

But beyond just convenience, digital wallets also come with many benefits for eCommerce stores. In this post, we’ll dive deeper into the benefits of incorporating digital wallet capabilities into your eCommerce storefront and how they can help you sell more.

What Is a Digital Wallet?

A digital wallet is a convenient financial transaction application accessible from any connected device. It is a virtual wallet that securely stores your payment information and passwords in the cloud.

This means that you can easily access your payment details and make purchases online without entering your credit card or other payment information each time.

Aside from storing payment information, digital wallets can also store other important cards and documents, such as gift cards, membership cards, loyalty cards, coupons, event tickets, plane and transit tickets, hotel reservations, driver’s licenses, identification cards, and even car keys.

This feature can be especially helpful for users who want to keep all their important information in one place and easily accessible from their digital devices. Nearly half of all online transactions worldwide, according to a 2021 projection, were funded by digital and mobile wallets.

The report also forecasts that by 2024, this percentage will increase to 53%. With digital and mobile wallet payments making up over 69% of all e-commerce payments, the Asia-Pacific region has the biggest market share for online wallets.

Below are the types of digital wallets that help with your eCommerce store sales:

1. Pass-Through Digital Wallet

A pass-through digital wallet functions as an intermediary between the user’s bank account and the merchant. It stores the user’s card details and security information within the wallet and generates a unique token for each transaction. This token serves as a stand-in for the actual card details, so sensitive information is not shared with the merchant.

When a user initiates a transaction with a pass-through wallet, the wallet communicates with the merchant’s payment system to authorize the transaction. Instead of transmitting the user’s actual card details, the wallet sends the unique token. The merchant’s payment system uses this token to request payment from the user’s bank account.

By using tokens, pass-through wallets provide an additional layer of security for users. Tokens are generated for each transaction and can only be used once, so they cannot be used for fraudulent purposes. Furthermore, since the wallet does not store the user’s card details, it is less vulnerable to security breaches.

2. Stored Wallets

These wallets work by allowing users to load funds onto them, either manually or automatically, before they can make a transaction. Once funds have been loaded, users can then make purchases or payments by drawing from the balance in their wallet.

One of the advantages of stored value wallets is that they can help to simplify the payment process by eliminating the need for users to enter their payment information for each transaction. This can lessen the chance of mistakes or fraud while also saving time.

Another benefit is that these wallets can provide users with a sense of security by keeping their payment information in one place rather than sharing it with multiple merchants. This can help to prevent unauthorized access or theft of sensitive data.

3. Closed Digital Wallet

Imagine you have a set of keys; each key can unlock a specific door, but no other doors. Similarly, closed digital wallets are like keys that can only be used to unlock the digital doors of a specific retailer’s store.

Just like how loyalty cards are exclusive to particular stores, closed wallets are exclusive to specific retailers. With a closed wallet, the retailer has complete control over the credit lines and spending limits, which means that customers can only use the wallet to make purchases within the retailer’s store or website.

In a way, closed digital wallets are like having a personalized shopping experience tailored to your favorite store. They allow the retailer to offer exclusive promotions and rewards to customers while providing a secure and convenient payment method for shoppers.

How Digital Wallets Work

There are several technologies that digital wallets use to facilitate payments, including:

- QR Codes

QR code – Image Source: NBC News

QR codes are a popular payment method that uses barcodes to encode transaction information. The user simply scans the QR code with their smartphone camera or digital wallet app, initiating the payment. This technology is commonly used in-store, where merchants can generate QR codes that shoppers can scan to pay for items using their digital wallet accounts.

- Near Field Communication (NFC)

This technology allows users to make payments by simply tapping their mobile device or digital wallet against an NFC-enabled payment terminal. NFC payments are commonly used for in-store transactions and can be faster than traditional payment methods. Below is a demonstration of NFC in work.

- Magnetic Secure Transmission (MST)

Magnetic Secure Transmission (MST) is an innovative mobile payment technology that revolutionizes the way smartphones conduct wireless transactions. It empowers users to make payments effortlessly by simulating the magnetic signal produced when swiping a traditional magnetic stripe card. With MST, both old-school magnetic stripe systems and modern no-swipe credit card terminals can seamlessly process these wireless transactions.

MST offers secure and convenient payments without requiring equipment upgrades. Users can transact confidently, saving costs and hassle, as their existing infrastructure remains compatible with this cost-effective solution.

Benefits of Using Digital Wallets

There are several benefits of using digital wallets for eCommerce store sales, including:

1. Increases the Number of Payment Options

In today’s world, customers have various payment options available to them, and they expect online businesses to offer multiple payment methods to make the payment process convenient and secure.

Customers may have varying preferences regarding payment options based on their prior experiences, convenience, and security concerns. As an eCommerce store owner, you can serve a wider range of client preferences and improve the likelihood of a sale by providing a wider choice of payment methods, including purchases made through digital wallets.

Customers are more likely to trust and feel at ease utilizing payment methods that they are accustomed to and have used in the past. Digital wallets have also been more popular recently because they provide extra security by keeping payment information encrypted and concealed from retailers, lowering the risk of fraud and theft.

Customers value the extra protection, and companies that accept digital wallet payments are seen as more dependable and trustworthy. Businesses can build a solid reputation and attract repeat customers who are more inclined to visit the store again for subsequent purchases by meeting customers where they feel comfortable.

2. Helps Clients Receive Rewards

Customers can make payments easily and securely using digital wallets, and adding perks and incentives makes the deal more enticing. Allowing customers to use digital wallets to pay for their purchases makes the checkout process faster and allows them to get rewards or payback.

Customers are more inclined to return and make further purchases when they believe they receive more value for their money. Customers will associate your brand favorably since they will feel appreciated for their devotion as a result. Additionally, by providing incentives for using a digital wallet, you might be able to draw in new clients who are eager to use your service and are interested in earning incentives.

3. Tighter Security Increases Authorization Rates

In the ever-evolving landscape of online commerce, security is a major concern for both merchants and customers. As governments and payment providers tighten their security protocols, merchants find it increasingly difficult to accept credit card payments and maintain high authorization rates.

However, digital wallet payments offer a solution to this issue. When customers use digital wallets to make payments, the security burden is largely on the digital wallet companies. This is because digital wallets leverage the security features of mobile devices, such as passcodes and fingerprint recognition, to enhance transaction and personal information protection.

Furthermore, digital wallet providers implement robust security measures within their software, enabling faster and more efficient authentication and authorization of payments. This increased security can lead to higher authorization rates for merchants who accept digital wallet payments.

All this can result in fewer payment declines and chargebacks for merchants, ultimately saving them time and money.

4. Encourages Younger Demographics

Recent surveys show that many Gen Z and younger Millennials are making mobile wallet purchases. One of the surveys found that 57% of Gen Z owned mobile wallets in 2021, while 65% of younger Millennials used them more frequently.

According to this pattern, these groups are increasingly using digital wallets for payment. Businesses must pay attention to these generations’ tastes as their spending power grows. By offering a quick, safe, and interesting payment option, digital wallets provide a method to achieve just that.

Digital wallets are popular among younger generations in part because of their convenience. Customers may securely save their payment information in a digital wallet, speeding up and simplifying checkout. Younger consumers accustomed to quick, smooth digital interactions may find this particularly tempting.

5. Ensures Mobile Device Checkout is Optimized

As mobile commerce continues to grow, merchants must ensure that their checkout process is optimized for mobile devices. However, the mobile checkout experience often falls short of the desktop experience, leading to higher cart abandonment rates. This is where digital wallets come in.

Digital wallets are stored and accessible from mobile devices, making them an ideal payment method for mobile checkout. By offering digital wallet payment options, merchants can provide a smoother and more seamless checkout experience on mobile devices, reducing friction and increasing the likelihood of a completed sale.

With digital wallets, customers can easily store and access their payment information from their mobile devices, eliminating the need to manually enter payment information each time they purchase. This streamlined checkout process can significantly reduce the time and effort required to complete a transaction on a mobile device, making it more likely that customers will follow through with their purchase.

In addition, many digital wallets offer built-in security features such as biometric authentication, further simplifying the checkout process and instilling trust in customers who may be hesitant to purchase mobile devices.

Cons of Using Digital Wallets

Despite the growing popularity of digital wallets driven by their convenience and user-friendly nature, there are notable drawbacks associated with their usage:

1. Security Concerns

Digital wallets are vulnerable to hacking and fraudulent activities, and users’ personal and financial information can be compromised. It is essential to choose a reputable digital wallet provider and take steps to secure your account with strong passwords and two-factor authentication.

2. Technical Issues

The wallets rely on technology, and if there is a technical glitch or outage, users may be unable to access their funds or complete transactions. Additionally, if a user loses their device or it is stolen, they may be unable to access their wallet without their backup code.

3. Limited acceptance

While digital wallets are becoming more widely accepted, not all merchants and businesses support them as a form of payment. This can be frustrating for users who prefer to use their digital wallet for all transactions.

4. Fees

Some digital wallets charge fees for certain transactions, such as withdrawals or currency conversions. Users should be aware of these fees and factor them into their decision to use a particular digital wallet.

5. Privacy Concerns

Digital wallets require users to link their financial accounts, which can raise privacy concerns. Users should research the privacy policies of digital wallet providers before using them and consider the risks of sharing their financial information.

Examples of Digital Wallets

There are several digital wallet providers available, each with its own unique features and capabilities. Here are examples of digital wallets:

1. PayPal

PayPal is one of the most widely recognized digital wallets, offering users the ability to send and receive money, make online purchases, and store multiple payment methods. PayPal supports over 25 currencies and offers buyer protection and fraud monitoring.

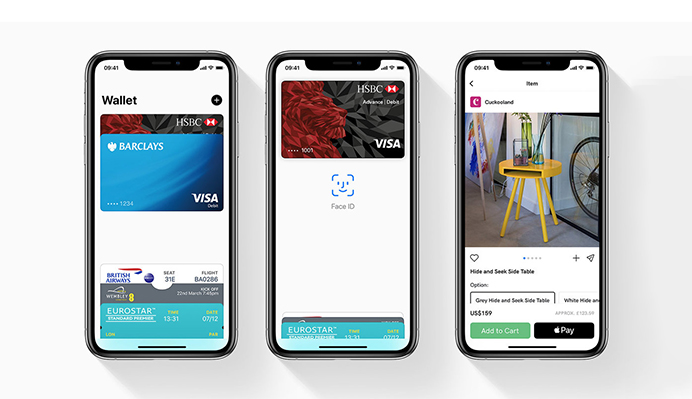

2. Apple Pay

Apple Pay is a digital wallet that allows users to make payments using their iPhone, Apple Watch, or iPad. Users can add multiple debit or credit cards and make purchases in-store, in-app, and online.

Apple Pay uses tokenization and biometric authentication for added security. Below is an example of how to make payment with Apple Pay

3. Google Pay

Google Pay is another popular digital wallet that lets users make payments using their Android devices or desktop browser. Google Pay supports multiple payment methods, including debit and credit cards, bank accounts, and PayPal. It also offers contactless payments and reward points for eligible purchases.

4. Samsung Pay

Samsung Pay is a digital wallet available to Samsung smartphone users that allows them to make payments using their devices. Samsung Pay supports multiple payment methods, including credit and debit cards, and offers contactless payments using NFC and MST (magnetic secure transmission) technologies.

5. Venmo

Venmo is a digital wallet and payment platform that lets users send and receive money from friends and family. Venmo is primarily used for peer-to-peer transactions, but users can also make online purchases and split bills with their contacts. Venmo offers social features, allowing users to share payments and comments with their contacts.

6. Coinbase Wallet

Coinbase Wallet is a mobile digital wallet explicitly designed for cryptocurrencies. Users can store and manage their digital assets, including Bitcoin, Ethereum, and other popular cryptocurrencies. Coinbase Wallet also allows users to send and receive cryptocurrencies, and it offers biometric authentication and other security features to protect users’ assets.

Conclusion

Digital wallets offer numerous benefits for eCommerce store sales, including improved convenience, security, and faster checkout times. Digital wallets offer customers a convenient payment method that doesn’t require them to manually enter their payment details each time they make a purchase.

There are various types of digital wallets available. Each type has its unique features and advantages, making it essential for eCommerce businesses to choose the one that best fits their needs and target audience.

However, digital wallets also have some potential drawbacks, such as limited acceptance by merchants, compatibility issues with certain devices, and the risk of losing access to funds due to technical glitches or fraud.

Despite these challenges, digital wallets remain a popular payment option for online shoppers, and eCommerce stores can benefit significantly by incorporating them into their payment systems.

By providing a hassle-free and secure payment experience, digital wallets can help eCommerce businesses attract more customers, increase conversions, and build lasting relationships with their audience.

Acowebs are the developers of the WooCommerce Deposits– Partial Payments plugin that helps the customers pay a fixed price, percentage, partial payment, or deposits, for the products purchased from your Woocommerce store. It has also developed various other plugins, like WooCommerce Currency Switcher, the multi-currency converter plugin that shows prices in the user’s local currency and helps customers connect to desired products faster. It helps customers quickly compare products and make a judgment.

Login

Login

Cart

Cart