As the global economy hovers on the verge of recession, most people are worried about their financial positions. Markets worldwide are flashing warning signs that the global economy is on the verge of collapsing. COVID-19 and the war in Ukraine have been major factors slowing the economy down.

Although there were hardships in most business setups, eCommerce sales thrived during the pandemic compared to brick-and-mortar stores. However, they are not safe from the threatening upcoming recession.

As an owner of an eCommerce business, the question of how to recession-proof your business is normal and necessary.

The idea entails taking proactive measures to ensure that your company can withstand any economic downturn. When considering recession-proofing, you might face the challenge of choosing the right ideas to achieve your goals.

While a recession is never easy for a business, we will assist you in keeping your brand organized and efficient, strengthen your operational processes against economic difficulties, and thrive during the unavoidable boom that will follow throughout the article.

This article will cover recession causes, impacts, and tips to weather the threatening recession.

What Is Recession?

Recession Concept – Image Source: Bound

A recession is a significant drop in economic growth that can last for several months or even years. It is an inevitable part of the economic cycle or the irregular growth and decline in a country’s economy.

Recession is declared if a country’s economy experiences negative GDP, industrial production for a prolonged period, dropping retail sales, etc. When the recession persists, it is considered a depression.

The Great Depression of the 1930s and the Great Recession of 2007–2009 are two significant economic downturns that have happened in the past.

It’s important to understand how major recessions occur so that you can prepare for these sudden economic changes. Making your business downturn-proof entails being adaptable and utilizing your resources to ensure your company survives a downturn.

It is good to be familiar with economics and the factors that influence it. In that case, you’ll know how to respond to current situations and predict future recessions, which is vital for everyone in the modern world.

This includes business owners, consumers, shareholders, and government officials responsible for regulating and promoting the economy within their country or region.

What Are the Causes of a Recession?

Economists use various statistical data and patterns to determine whether an economy is in recession. As an eCommerce business owner, such indicators will help you plan your recession-proof strategies. The following are indicators of a recession:

- If unemployment is increasing.

- Increased bankruptcies, missed payments, and evictions.

- Interest rates falling.

- If consumer spending and confidence are going down.

- Falling asset prices.

Below are the causes of inflation:

1. Excessive Inflation

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. It is measured as an annual percentage increase. As inflation rises, every dollar buys fewer goods and services.

Inflation is not inherently bad, but excessive inflation is a destructive process. The main causes of inflation are:

- Demand-pull inflation. Demand-pull inflation occurs when the demand for goods and services outpaces the increase in supply. This generally happens during fast economic development when consumer demand for goods and services exceeds manufacturers’ ability to meet that need.

- Cost-push inflation. Cost-Push inflation happens when rising input costs, such as those for labor, raw materials, or energy, drive up the price of output. This kind of inflation is typically brought on by a rise in the cost of manufacturing, which raises prices.

- Structural inflation. Economic structural changes, such as those affecting the labor market or how products and services are produced, lead to structural inflation.

Central banks increasing interest rates control inflation, and an increase in interest rates dampens business activity.

Excessive inflation can cause a recession by reducing the purchasing power of consumers. Consumers have less money to spend on goods and services when prices rise faster than wages. This can lead to a decrease in demand and a decrease in production.

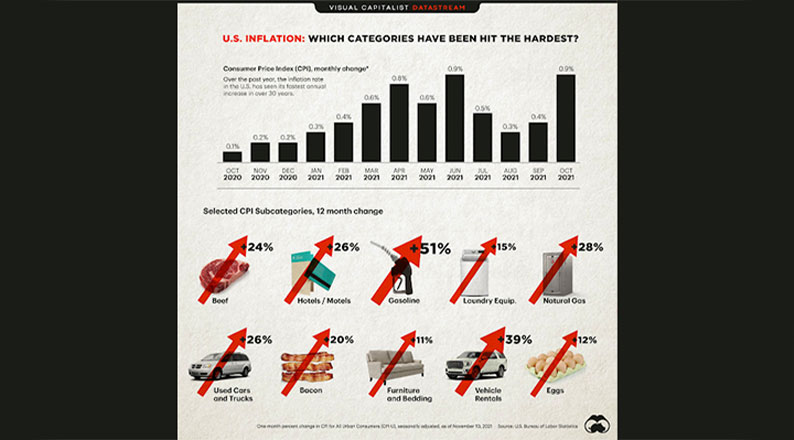

Below is an example of commodities that have been hit by inflation.

Products Affected by Inflation – Image Source: World Economic Forum

2. Deflation

The opposite of inflation is deflation. This is when the prices of products and assets fall due to a sharp drop in demand. Over time, falling prices have a more serious impact on the economy than inflation.

Deflation reduces the value of goods and services sold in the market, causing people to wait until prices fall before buying them. When demand falls, prices also fall as sellers try to attract buyers leading to a recession. Deflation can also lead to a decrease in borrowing due to higher real interest rates. This can lead to a decline in investment, further reducing economic activity.

Consumers see this decline and wait for these prices to drop, reducing demand even further. A downward spiral reduces economic activity and increases unemployment, leading to a sustained downward spiral or slower economic activity and higher unemployment.

3. The Decreased Spending by Consumers and Businesses

During inflation, economic output, employment, and consumer spending all fall, leading to a recession. Interest rates may also fall as central banks, such as the Federal Reserve, lower interest rates to support the economy.

The government’s budget deficit is widening as tax revenues fall while spending on unemployment insurance and other entitlement programs rises.

4. Excessive Debts

When people or businesses take on too much debt, the cost of servicing it can grow to the point where they can’t pay their bills. This can lead to defaults and bankruptcies, which can cause a recession.

Also, excessive debts can cause a recession by leading to a decrease in consumer spending. When consumers have high levels of debt, they are less likely to spend money on goods and services.

This decrease in spending can lead to a reduction in production and employment. The Great Recession is a good example of excessive debt.

5. Assets Bubbles

Asset bubbles are times when the price of an asset increases quickly without being supported by its underlying fundamentals.

Asset Bubbles Examples – Image Source: Investopedia

When an asset’s market price increases far above its inherent worth and the increase are driven by speculation, frequently due to a big inflow of funds from investors, an asset bubble is created.

Any asset class, including stocks, bonds, commodities, and real estate, is substantially susceptible to asset bubble formation. When an asset bubble develops, its market price rises fast and sharply, frequently surpassing its intrinsic worth.

Investor momentum and speculation, who think the asset’s price will only rise, are to blame for this price surge.

How to Recession-Proof Your eCommerce Business

Now that you know a recession is unavoidable, you need to adapt to it. Here are some tips to help your eCommerce company weather the next recession:

1. Identify Your Target Market

A recession is a perfect time to invest in marketing. While your competitors are cutting back on their marketing budgets, you can increase your marketing spending and gain market share.

Suppose your target audience is price sensitive, and you anticipate they will turn to inexpensive options in your product category. In that case, you should target your website’s products and services. This will make you an excellent solution to their low-cost preference and help you generate more sales.

2. Develop a Strategy for Reaching Your Target Market

Create a Target Market Strategy – Image Source: FasterCapital

Your marketing strategy is critical to your business’s success, so you must consider how to maximize your marketing budget during an economic downturn or recession.

As a business owner, it is your responsibility to find ways to adapt to changing consumer behavior and position your business for growth regardless of the economic environment.

You always want to target the right audience with your marketing and advertising, but in a downturn, precise targeting becomes critical—especially when marketing budgets are tight, as it eliminates clicks on irrelevant ads.

You may need to change your focus in order to focus on a specific segment within your audience, perhaps even an emerging one. Know what your customers want right now and make any goal adjustments accordingly.

You should also segment your social management tools list based on new patterns and retarget your website visitors to target the right audience and get a higher ROI in your marketing efforts.

3. Create a Product That Meets the Needs of Your Target Market

There is a certain amount that customers are willing to spend, and if you can figure out that amount and quote as close to that price as possible, you can maximize your profit. He recommends researching and bundling products to do this.

Remember not to over-price. Recommend products that are within the buyer’s budget. Promote products within the 10-50% cost range of the product of their choice. Anything beyond that would overwhelm them.

4. Diversify Your Product Offerings

Don’t rely on just a few products to drive your sales. Large businesses will likely cope better with downtown since most are already established and diversified.

Introducing a new commodity might be hard, but with online stores, it becomes easy to introduce new products due to the existing basic business apparatus like IT.

Offer a wide range of products and services to appeal to a broad range of customers. You can learn about customers and expert opinions before introducing a new product. Diversification does not have to entail generating completely new products or shifting your company’s focus.

Instead, you should look for opportunities to expand using your existing facilities and skills. This will help insulate your business from the impact of a recession, as customers will still need to buy goods and services, just maybe not the same ones they bought before.

Ensure that you have enough resources to support your products. Otherwise, promising customers of products that are not available will spoil your entity image.

5. Focus on Customer Retention

Customer Retention Strategies – Image Source: Business Wire

During a recession, a loyal customer base is your only real asset. It’s cheaper, easier, and more effective to market to existing customers than to focus on attracting. In a recession, customers will be looking to cut costs wherever possible.

Ensure you’re doing everything possible to keep your customers happy and loyal. This includes providing excellent customer service, offering competitive prices, and running loyalty programs. In a recession, customers are looking for bargains.

Also, your prices must be competitive and in line with what customers are willing to pay. You may need to adjust your prices downwards to stay competitive.

6. Cut Costs Where You Can

Cutting costs is among the best ways to recess – proof your eCommerce business. A recession is not the time to be wasteful. Your revenues are likely to fall during this period. Look for ways to cut costs without compromising the quality of your products or services.

This may include non-essential outsourcing tasks, negotiating better deals with suppliers, or automating processes. Some cutting costs strategies are hard, e.g., laying off employees. You might initially fight and feel hesitant, but if it makes sense, you can go ahead with the plan.

Ensure to explain to your employees why that is happening. The good thing is that when there is a recession, both the employee and the employer feel the heat.

You should also identify your top-notch talent in the organization and focus on enriching and utilizing their skills. Automated processes are fast and factual. Utilizing them will cut on costs needed to remunerate physical workers.

7. Increase Your Online Presence

In a recession, customers will be spending more time online. Conversely, your competitor will likely reduce marketing budgets, leading to limited appearances on the internet and social media.

According to research, many shoppers will be hesitant to spend time in stores for the next year or more, making it a good time to invest in digital tools. Cutting costs doesn’t necessarily mean limiting what brings you money, especially as an online store owner.

Your presence online helps you understand your customers’ behavior and share the pain of the recession with them.

Make sure your eCommerce business is visible online and easy to find. Invest in SEO and social media marketing to ensure you’re reaching your target audience. Gaining a foothold in people’s minds is critical for when the economy recovers.

During an economic downturn, digital marketing is your most cost-effective resource.

It is also simple to track, giving you the best way to determine your return on investment and how well your marketing campaign is performing. You should understand that your marketing budget is not an expense but an investment.

According to Statista, Facebook, LinkedIn, and Instagram are the most common social media used for marketing. You can utilize any depending on what you deal with. Below is a matrix from Harvard Business Journal you can use to understand your customers’ needs.

8. Offer Flexible Payment Options

In a recession, cash flow is often tight. Offer customers flexible payment options, such as payment plans, to make it easier for them to buy from you. This will help you increase sales and improve customer satisfaction.

Your clients are most in need of you at this time. Since they are aware that they will require the necessary goods in any case, some business owners may decide to exploit that opportunity to forgo having their customers’ best interests in mind. By doing this, you risk alienating potential clients.

Ensure that you guide your customers and employees on payment procedures, whether the mode is old or new. The last thing people want during a recession is delays and money landing in the wrong hands.

Flexible payment methods improve customer experience, and you won’t have to be worried about your customers leaving in the future when things get better.

9. Plan for the Worst

No one knows how long the recession will last or how deep it will be. Prepare for the worst by stockpiling inventory, reducing expenses, and increasing your cash reserves. This will help you weather the storm and come out the other side stronger.

Securing funding is always a good idea. When times are hard, most business owners always wish they have the funds to stay afloat. Most banks and loan facilities will be reluctant to lend you money during a recession due to fear of not being paid back on the agreed terms.

You can opt for revenue-based financing during the downturn period. Revenue-based financing provides capital to eCommerce business owners in exchange for a portion of continuing earnings.

This efficiently serves as an alternative to debt and equity-based financing. Your company has no upfront ownership, and no personal warranties are required.

Conclusion

Getting caught up in the doom and gloom of a recession is easy. However, staying positive and focused on your business goals is essential. Recessions don’t last forever; if you weather the storm, you’ll be better positioned to take advantage of the rebound.

A recession occurs for various reasons, such as asset bubbles, deflation, inflation, lower spending, and expensive debts.

Signs of a recession that we are experiencing today are evident such as a rise in unemployment, increased bankruptcies, missed payments, evictions, and interest rates falling If consumer spending and confidence are going down and falling asset prices.

A multifaceted strategy is needed to recession-proof your eCommerce business. You will survive a downturn by diversifying your product lines, emphasizing quality, using technology, investing in customer service, marketing your brands, optimizing websites, and providing special offers.

By implementing these actions, you are assured that clientele will be steadfast and your revenues will be stable despite tough economic issues.

Acowebs are the developers of the WooCommerce Deposits– Partial Payments plugin that helps the customers pay a fixed price, percentage, partial payment, or deposits, for the products purchased from your Woocommerce store. It also has developed various other plugins like WooCommerce Currency Switcher, the multi-currency converter plugin that shows prices in the user’s local currency and helps customers connect to desired products faster. It helps customers quickly compare products and make a judgment easily.

Login

Login

Cart

Cart