In today’s digital age, securing online purchases through transactions has become critically important. Emerging as a game-changing solution, biometric payments offer both convenience and heightened protection.

This cutting-edge technology utilizes unique physical traits, such as fingerprints or facial features, to verify identity during monetary dealings.

As cyber threats progress, biometric payments are gaining recognition as a robust shield against fraud and identity theft. The scope of biometric payments is expanding rapidly, transforming how individuals interact with fiscal services.

This article examines the progression of biometric payment innovations, exploring current status and engineering advances guiding potential futures. It considers the fundamental mechanisms, impacts on retail and e-commerce sectors, and benefits and difficulties when adopting.

Additionally, the article views projected implications and market estimations, sharing perceptions on possible wide-scale implementation of biometric validation in secured online exchanges.

The Evolution of Biometric Payment Technology

Biometric payment technology has advanced notably since its introduction. This advanced transaction technique authenticates individuals during payments by leveraging the distinctiveness of biological attributes, including fingerprints, facial contours, retinas, veins, and voice.

Biometric payments’ development began with antiquated societies exploiting physical traits for authentication, though modern biometrics did not emerge until the late 1800s.

From Fingerprints to Facial Recognition

The evolution of biometric payments has seen notable technological progress. Fingerprint recognition, the most preferred among biometric options, gained traction in the early 2000s when Pay By Touch introduced one of the initial fingerprint-based payment mechanisms.

The 2010s witnessed a major shift as biometrics transitioned from government and institutional use to consumer devices. Apple’s introduction of Touch ID on the iPhone 5S in 2013 brought biometric technology into the mainstream, letting users unlock their devices and authenticate payments using their fingerprints.

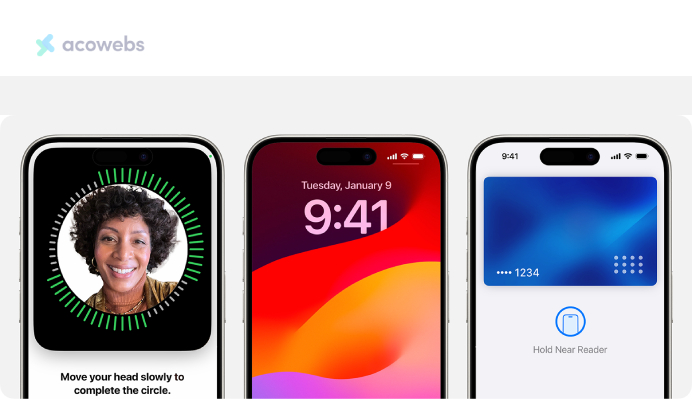

Facial recognition has also grown into a more commonly accepted form of biometric identification, likely gaining popularity through integration with smartphone digital wallets from Apple and Samsung.

The technology has advanced to incorporate 3D facial recognition, which utilizes depth sensors to capture the detailed shape of a face, increasing accuracy while making it more difficult to bypass authentication attempts using photos or masks of an individual.

Here are some of the popular biometric payment methods:

- Fingerprint Recognition: This method remains the most popular among biometric alternatives, probably owing to the extensive utilization of smartphones.

- Facial Recognition: Becoming more widely used through the inclusion of smartphone wallets like Apple Pay and Samsung Pay, facial recognition has developed into a generally recognized form of biometric authentication.

- Additional Techniques: Voice recognition, iris scans, and palm vein patterns also find some application, if less widespread adoption.

Key Players in the Biometric Payment Space

Several companies have emerged as leaders in the biometric payment industry:

- Apple: Greatly impacted the industry with the 2014 launch of Apple Pay, integrating the company’s Touch ID fingerprint authentication and later Face ID facial recognition technologies into its devices.

- Samsung: Entered the market in 2015 with Samsung Pay, leveraging fingerprint and iris scanning capabilities in its solutions.

- Mastercard: Emerged as a leader in the market, especially with their biometric payment card prototype incorporating fingerprint authentication.

- Amazon: Demonstrated innovation with Amazon One, allowing customers the convenience of using individual palm characteristics for contactless payment processing.

Consumer Adoption Trends

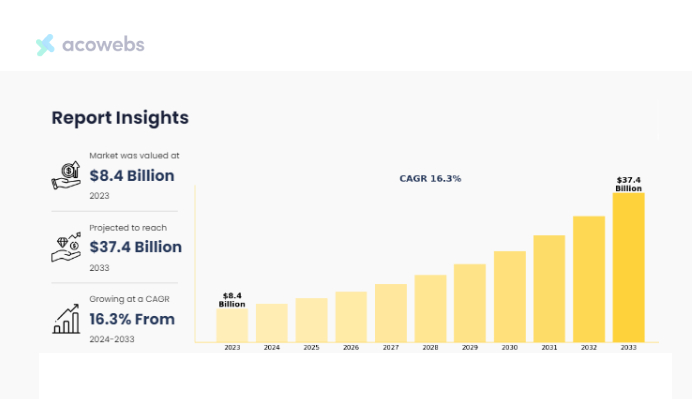

Consumer adoption trends indicate rapid growth in the biometric payment market, propelled by increasing preference for secure online transactions and convenient payment alternatives.

In 2023, the global biometric payment market was valued at USD 8.40 billion, projected to reach USD 37.40 by 2033 rising at a CAGR of 16.3% from 2024 to 2033.

This expansion owes to widespread smartphone integration of biometric sensors and heightened cybersecurity concerns.

The familiarity with biometric technology embedded in phones and personal devices has elevated customer acceptance of biometric payments. However, adoption varies across age groups.

A 2022 NordVPN study showed Gen Z (18-26) and Millennials (27-42) exhibit the highest usage of fingerprint, facial, and eye scanning authentication. Nearly a third of Millennials believe biometrics enhance protection, and one-quarter supplement passwords with biometrics.

Conversely, less than a quarter of Gen X (43-58) consider biometrics protective, and just a third employ daily fingerprint scanning. Fewer than half of Baby Boomers (59-77) utilize fingerprint, facial, or eye scanning regularly, expressing the highest biometric skepticism.

This disparity presents opportunities to boost adoption through further education and accessibility across demographics.

As biometric payment systems continue to evolve, they offer a trifecta of benefits: fraud reduction, enhanced customer convenience, and streamlined operations. The adoption of biometric payments is expected to accelerate, driven by consumer demand for convenience and heightened security.

How Biometric Authentication Technologies Secure Online Transactions

Biometric payment systems leverage distinctive physical or behavioral characteristics to confirm someone’s identity before processing a transaction. These systems depend on refined technologies to obtain, retain, and validate biometric information, allowing for protected and easy payment interactions.

Biometric Data Capture and Storage

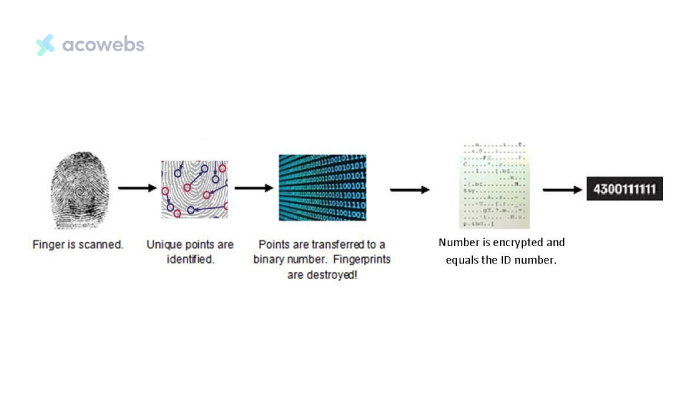

The process begins with registering the user’s biometric information. This involves capturing specific physical characteristics such as fingerprints, facial features, iris patterns, or voice samples.

The captured data is then converted into a digital template and securely stored, typically on the device’s built-in chip rather than on the fintech brand’s servers.

Various biometric capture methods are employed:

- Fingerprint scanners: The most common method widely used in smartphones.

- Facial recognition: Uses infrared light to scan and map facial features.

- Iris or retinal scanners: Capture unique patterns in the eyes.

- Voice recognition: Analyzes unique voice patterns, including accent and speech rate.

- Vein recognition: Uses near-infrared light to scan vein patterns in the palm or finger.

Authentication Algorithms

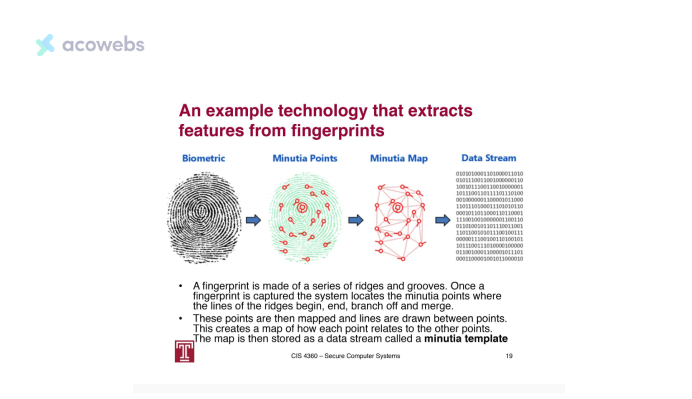

Biometric recognition is achieved by comparing the acquired biometric sample (the “query”) with previously captured and stored samples (the “reference” or “gallery”).

Sophisticated algorithms process this data to verify or identify individuals:

- Quality assessment and enhancement

- Feature extraction

- Classification/indexing

- Matching and fusion

- Compression algorithms for efficient storage and transmission

These algorithms are designed to be shift-invariant, allowing for distortion tolerance and providing closed-form solutions. This ensures accurate authentication even with slight variations in biometric input.

Integration with Existing Payment Infrastructure

Biometric payment systems are designed to seamlessly integrate with existing payment infrastructure.

This integration allows for the creation of bio-eWallets, which securely store credit cards, banking details, and identification documents with an added layer of biometric authentication.

The integration process typically involves:

- Linking biometric data to payment accounts

- Implementing secure communication protocols

- Ensuring compliance with financial regulations and standards

Frameworks developed by organizations like the FIDO Alliance and EMVCo guide the deployment of secure and interoperable biometric payment systems, facilitating wider adoption and consistent user experiences across devices and platforms.

Benefits and Challenges of Biometric Payments

Enhanced Security and Fraud Prevention

Biometric payments provide robust protection against fraud by applying distinctive physical features for validation. This innovation possesses the probable capacity to fight biometric fraud proficiently, as it depends on human body traits to confirm dealings.

Contrary to traditional techniques like passwords or PINs, biometric information intrinsically connects to an individual and is significantly harder to replicate or misuse.

Implementation of liveness detection in biometric payment mechanisms additionally improves protection by evading identity theft attacks and making impersonation more complex using fake imagery or videos.

Improved User Experience

Biometric authentication streamlines the payment process, enhancing customer convenience and satisfaction.

Users can complete transactions quickly by simply looking at a camera, speaking into a microphone, or hovering their palm over a device, significantly reducing authentication time.

This seamless experience can drive customer loyalty and potentially boost sales and revenue. The technology eliminates the need to remember numerous passwords, minimizing data breaches and simplifying the overall payment experience.

Privacy Concerns and Data Protection

Despite its benefits, biometric payments raise significant privacy concerns. The collection and storage of biometric information pose risks of unauthorized access and misuse. Function creep, where data is used for purposes beyond its original intent, is a potential issue.

Additionally, the covert or passive collection of biometric data without consent challenges traditional notions of privacy.

To address these concerns, robust data encryption and strict adherence to privacy regulations are crucial for safeguarding biometric information during storage and transmission.

Innovations in Biometric Payment Technology

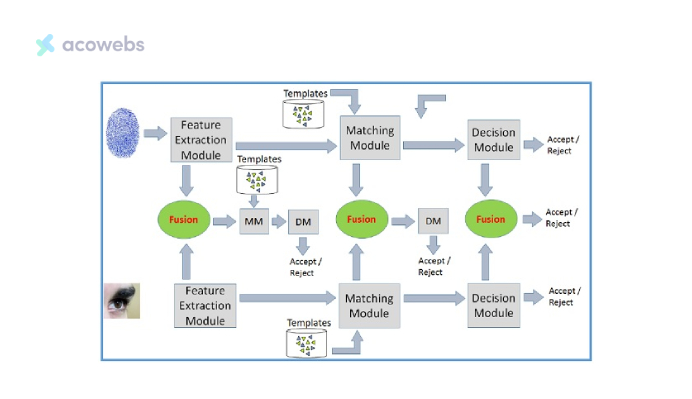

Multi-modal Biometric Systems

The biometric payment landscape is evolving with the introduction of multi-modal systems. These advanced mechanisms leverage multiple biometric authentication forms for more robust account security.

By combining diverse biometric characteristics, including facial recognition, voice analysis, and even gait identification, multi-modal setups offer enhanced protection and accommodate individual preferences.

One key advantage of multi-modal biometrics involves the possibility of better accuracy. These mechanisms employ a “feature-level” data fusion technique integrating data from two distinct authentication systems, providing faster reference set retrieval across identity outlines and significantly upgrading precision against unimodal systems.

This approach also helps in reducing false acceptance and rejection rates, making the authentication process more reliable.

The fusion can occur at any of the following phases:

- During feature extraction.

- During live sample/stored biometric template matching.

- During decision-making.

- Multimodal Biometric System

Multimodal biometric systems integrating or merging information at initial stages are considered more effective than those merging at later matching score comparison modules. The obvious reason is that the early stages contain more accurate information than comparison modules.

Combining fingerprint, facial recognition, and voice biometrics at the “feature level” permits systems to cross-reference templates, strengthening reliability while maintaining usability.

AI and Machine Learning in Biometric Authentication

Artificial intelligence (AI) and machine learning (ML) play important roles in the progress of biometric payment innovations. AI-driven algorithms persist in learning and adapting, making biometric mechanisms more robust and dependable.

These technologies specifically assist in improving facial recognition’s accuracy by examining facial traits and matching a database.

Machine learning techniques such as convolutional neural networks (CNNs), deep neural networks, and recurrent neural networks are being employed in biometric data fusion.

For example, a dual-stream CNN method has been devised for periocular identification, accepting RGB ocular photographs plus another novel color-textured description to depict periocular characteristics for identification amid troublesome environments.

Emerging Biometric Modalities

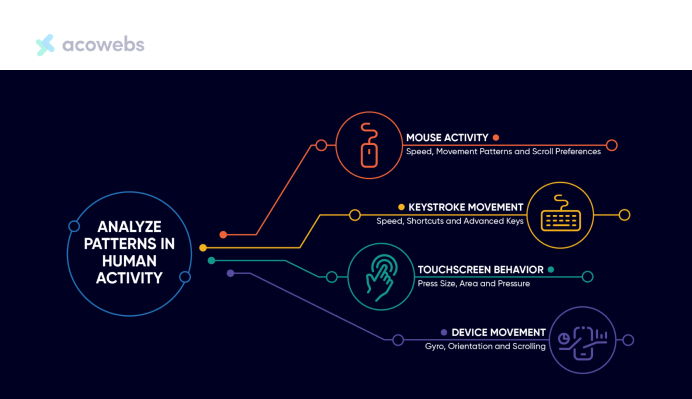

As the field of biometric payments expands, novel modalities emerge enhancing protection and user experience. Behavioral biometrics, which analyze usage designs including keystrokes, mouse motions, and typing patterns, are gaining traction.

These behavioral traits offer an exclusive method for validating users without relying solely on physical qualities. The designs are prohibitively difficult to capture and replicate, and they also evolve over time.

Behavioral biometric tools profile these patterns and subsequently evolve with the user. They leverage powerful statistical modeling and machine learning to notice the differences between a recognized user’s steady evolution and the unwanted presence of an entirely distinct user.

Another innovative approach is the use of palm recognition technology. As illustrated in the next section, palm scanning allows customers to make purchases simply by placing their palm over a scanning device.

This biometric methodology streamlines the payment process while also integrating age verification for buys like alcohol, abolishing the necessity for real ID checks.

Impact on Retail and E-commerce

Streamlining the Checkout Process

Biometric payment systems are transforming the checkout process for retail and e-commerce. By applying palm scanning technology, retailers can notably reduce friction during transactions.

For example, Amazon’s palm recognition system enables customers to make purchases simply by hovering their palm over a device, eliminating the need for physical payment cards or cash.

Your palm contains tiny, distinctive features on and below the surface, many imperceptible to the human eye or regular camera. Within seconds, a process using proprietary imaging and computer vision algorithms captures and encrypts your palm image.

Amazon One utilizes the information embedded in your palm to generate a unique palm signature that can be read each time it is used.

This streamlined approach not only heightens convenience but also improves the overall customer experience. Palm scanning demonstrates how biometric technologies can reinvent commerce through faster, simpler transactions.

Reducing Cart Abandonment

Abandoned shopping carts present a major problem for e-commerce businesses, often exceeding 70%. Biometric payments may help by streamlining checkout efficiency.

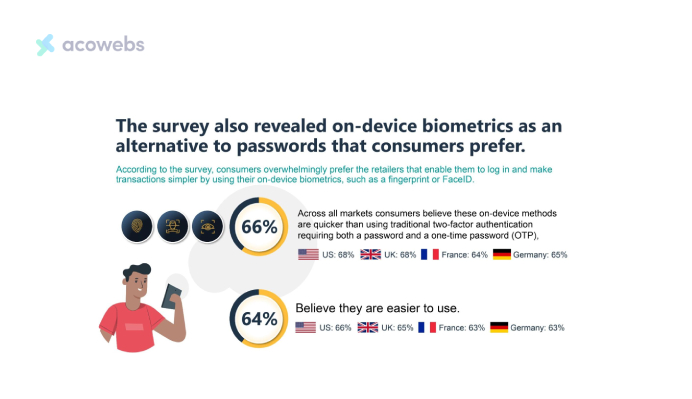

A study of 4,000 customers in the US, UK, France, and Germany by FIDO Alliance found that 60% ditched purchases due to password management troubles. They canceled transactions as passwords were either forgotten or new accounts/passwords faced creation to finish purchases.

Implementing biometric authentication like fingerprint or facial recognition can markedly lower abandonment rates. Consumers view such methods as swifter and easier to employ, with 66% believing increased speed compared to conventional two-step verification.

Streamlining checkout improves user simplicity and may convert more browsers to buyers, benefiting businesses’ income. Reducing abandoned carts through innovative identification could increase conversion rates.

Ultimately, biometrics that eliminate redundant steps while maintaining security may change e-commerce by addressing a leading cause of lost sales.

Enhancing Customer Loyalty Programs

Biometric technology is also reshaping customer loyalty programs. By incorporating fingerprint biometric sensor mechanisms into smart loyalty cards, retailers can connect customers to their cards, guaranteeing protected and customized loyalty information.

This approach allows for the creation of an “all-in-one card” that combines payments, loyalty programs, and identity confirmation, supplying a notable benefit for retailers desiring top-of-wallet reputation.

Combining biometrics in loyalty programs lets retailers collect additional usable information on consumer habits, facilitating customized customer routes and more appealing rewards.

Future Prospects and Market Projections

The biometric payment industry is anticipated to see substantial expansion in the coming decade based on forecasts. Estimates suggest its current value of around $8 billion will nearly quintuple to over $37 billion by 2033.

This projected over 16% annual growth rate on average is fueled by the growing need for both security and ease-of-use in digital payments, aided by proliferating smartphone use with biometric features built-in.

Growth Forecasts

Global contactless payments are expected to see tremendous growth over the next decade, with projections of a 19.1% average annual increase from 2022 to 2030. This expansion is fueled by the rising worldwide adoption of digital payment platforms that facilitate faster customer transactions.

Contactless systems incorporate advanced hardware, software, and services to enhance traditional methods and enable intelligent transactions. Meanwhile, the global iris recognition market is anticipated to grow at an even faster compound rate of 23.9% annually from 2023 to 2030.

Iris scans uniquely identify individuals by analyzing iris muscle patterns, which differ from retinal scans, which detect blood vessel configurations. Iris scan technology offers very high precision yet minimal risk of false authentication, boosting this segment’s predicted surge during the forecasted period.

Potential Disruptive Technologies

Artificial intelligence and machine learning are set to play a crucial role in advancing biometric payment technology. These technologies will enhance the accuracy of facial recognition and improve the overall security of biometric systems.

Edge computing is also expected to facilitate faster processing of biometric data, resulting in quicker authentication and improved user experiences.

Integration with IoT and Smart Devices

The integration of biometric payment technology with IoT and wearable devices presents promising opportunities for convenient and secure online transactions. Smart home devices, such as refrigerators and voice-activated assistants, could facilitate seamless and secure online transactions in the future.

Furthermore, the intersection of IoT and wearables in payment processing holds tremendous potential for a more connected and personalized consumer experience.

Conclusion

The future of secure online payments is rapidly evolving. Biometric authentication mechanisms utilizing unique physical traits provide a robust solution for conducting secure online transactions through frictionless authentication.

From early fingerprint recognition to advanced techniques like multi-modal biometrics and behavioral analysis, the industry continues to develop innovative ways to streamline the user experience while tightening security.

Major organizations have already integrated biometric solutions with significant impact, and projections anticipate unprecedented growth. With benefits like elevated fraud protection, accelerated checkout, and enriched loyalty programs, biometric payments show the potential to reshape the digital payment landscape.

As technology giants invest further in emerging areas such as AI and IoT integration, the prospects of this industry remain highly promising.

Acowebs are the developers of Woocommerce Custom Product Addons which is a optimized, lightweight, and fruitful plugin that is simply the best to add extra product options using its custom form builder easily. WooCommerce custom fields also comes with drag and drop form builder, 22+ field types and custom price formula.

Login

Login

Cart

Cart