Protecting your eCommerce store from fraud is not just a matter of security; it’s essential for the survival and success of your online business. In today’s digital age, where online shopping has become the norm, the threat of fraudulent activities has evolved and grown exponentially.

As the convenience of eCommerce has risen, so has the sophistication of cybercriminals seeking to exploit vulnerabilities in the system. The importance of safeguarding your eCommerce store cannot be overstated.

Beyond the immediate financial losses from fraudulent transactions, a security breach can erode customer trust and damage your brand’s reputation irreparably. It’s a competitive market, and consumers are increasingly cautious about where they shop online.

This evolution of fraud necessitates a proactive approach to security that keeps your business safe and ensures your customers feel secure when purchasing. In this guide, we will explore best practices to protect your eCommerce store from fraud, helping you to thrive in the digital marketplace.

Types of eCommerce Fraud

In 2022, online payment fraud resulted in $41 Billion in losses, and experts predicted a grim outlook for 2023, with global eCommerce fraud costs projected to exceed $48 billion. North America, at 42%, and Europe, at 26%, lead in terms of fraud value.

Additionally, between 2023 and 2027, cumulative global online payment fraud losses are estimated to surpass a staggering $343 billion, emphasizing the critical importance of robust fraud prevention measures. There are several types of eCommerce fraud:

1. Credit Card Fraud

This type of fraud involves the unauthorized use of stolen or counterfeit credit card information to make purchases online. Criminals typically target vulnerable eCommerce websites or stores and exploit the card data to buy goods or services without the knowledge or consent of the legitimate cardholder.

2. Chargeback Fraud

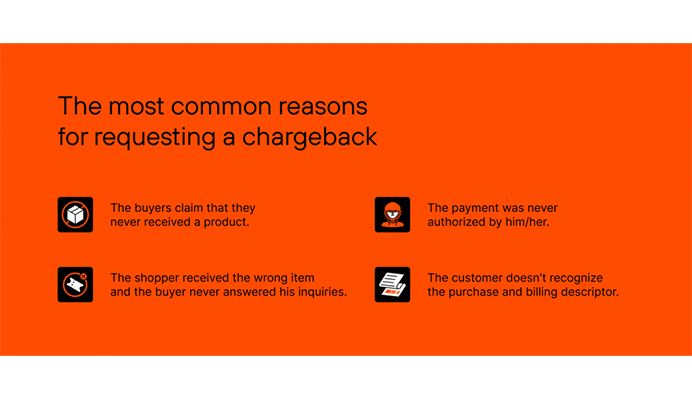

Chargeback fraud occurs when dishonest customers falsely dispute legitimate transactions with credit card companies or banks.

After receiving the product or service, these customers claim non-receipt, unauthorized charges, or other issues, leading to chargebacks. This results in financial losses for the business as they are often required to refund the disputed amount.

3. Card Testing

Fraudsters use stolen credit card details in card testing to make small, inconspicuous purchases. By doing this, they can verify whether the stolen information is valid before attempting larger and potentially riskier transactions. It’s a preliminary step in credit card fraud schemes.

4. Phishing

Phishing is a deceptive practice where scammers use fraudulent emails, websites, or messages that appear legitimate to trick users into revealing their login credentials.

Once the fraudsters obtain these credentials, they can gain unauthorized access to the victim’s online accounts, including those used for eCommerce.

5. Brute Force Attacks

A brute force attack is a method hackers use to gain unauthorized access to an account or system. They do this by methodically trying numerous combinations of usernames and passwords until they find the right ones.

This technique relies on persistence and can be time-consuming but is effective if weak or easily guessable credentials are used.

6. Credential Stuffing

Attackers take advantage of individuals who use the same usernames and passwords across multiple online services. They obtain login details from one compromised account and use them to access other accounts, exploiting the security vulnerability of password reuse.

7. Identity Theft

Identity theft occurs when individuals’ personal information, such as Social Security Number, is fraudulently obtained and used to create fake online user accounts.

These fraudulent accounts serve as a platform for criminals to carry out illicit actions, such as unauthorized purchases or deceptive schemes, using stolen or fictitious identities, potentially causing financial harm to victims.

8. Account Hijacking

Account hijacking occurs when fraudsters gain control of existing user accounts on eCommerce platforms. They do this by obtaining personal information, such as login credentials or security questions, through various means.

Once they gain access, they can carry out unauthorized transactions, change account details, or engage in other fraudulent activities.

9. Fake Reviews

Fake reviews are fabricated product or service evaluations posted on e-commerce websites to mislead consumers.

Fraudsters often create positive reviews to artificially boost a product’s reputation or negative reviews to harm competitors. This deceptive practice can influence purchasing decisions and undermine trust in online reviews.

10. Shipping Fraud

Shipping fraud involves various deceptive practices related to the delivery of products purchased online.

In this scheme, fraudsters manipulate shipping information to evade detection and receive stolen goods. They might alter shipping addresses, use drop points, or use fake addresses, making it difficult for authorities to trace the stolen merchandise back to them.

How do you Protect Your eCommerce Store From Fraud?

Now that we have seen the numerous frauds and security breaches that have plagued businesses, it is clear that safeguarding your eCommerce store is paramount. To help you protect your eCommerce store from these threats, here are essential strategies:

1. Choose a Secure eCommerce Platform

Selecting a secure eCommerce platform is vital for protecting your online store. Opt for platforms that employ advanced programming languages and adhere to robust security practices.

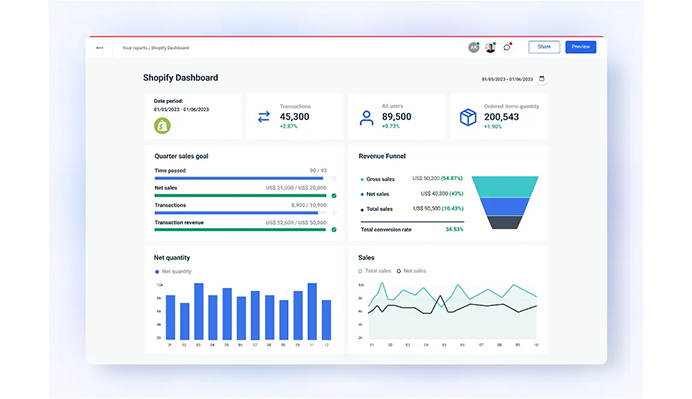

For instance, Shopify and WooCommerce are excellent choices as they consistently update their security features and offer tools to defend against prevalent online threats, bolstering the safety of your eCommerce operations. Below is a user-friendly Shopify dashboard.

2. Use Secure Connection and Be PCI Compliant

Utilizing a secure connection and achieving Payment Card Industry Data Security Standard (PCI DSS) compliance are critical steps in safeguarding your eCommerce store.

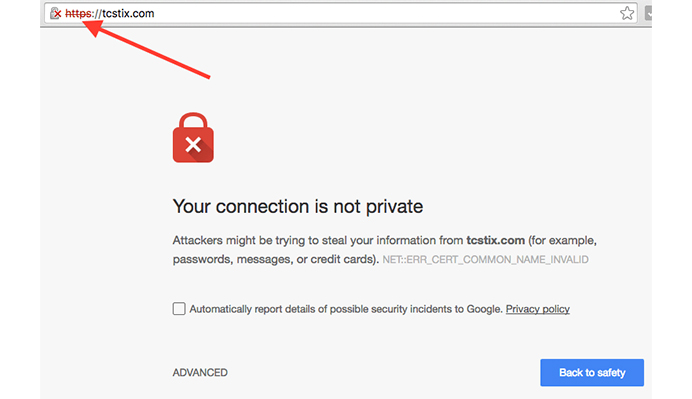

Strong SSL encryption (HTTPS) guarantees that all data exchanged between your website and customers remains confidential and protected from eavesdropping or tampering.

Furthermore, adhering to PCI compliance standards is imperative when handling payment card information, ensuring such data’s secure processing, storage, and transmission.

For instance, a padlock icon in the browser’s address bar indicates a secure and insecure connection, reassuring customers that their sensitive information is handled safely during transactions.

3. Avoid Storing Sensitive Data

Refrain from storing sensitive customer information to minimize the risk of data breaches. Store only essential data needed for legitimate purposes, such as processing refunds. PayPal is a good example that doesn’t store credit card information after completing a transaction.

4. Implement Address and Card Verification Systems

Implementing Address Verification Systems (AVS) and requesting the Card Verification Value (CVV) for credit card transactions enhances payment security by verifying the cardholder’s identity.

When customers make online purchases, they typically provide their billing address, which is cross-referenced with the address on record at the issuing bank, adding an extra layer of authentication.

Requiring the CVV, a three- or four-digit code on the card, also ensures the customer possesses the physical card.

These measures reduce the likelihood of fraudulent transactions, providing greater confidence to the merchant and the cardholder that the transaction is legitimate and secure.

5. Require Strong Passwords

Requiring strong passwords is vital to protect customer accounts and sensitive data. By implementing password policies that demand a mix of upper and lower case letters, numbers, and special characters, you increase the complexity of passwords.

This complexity makes it significantly more challenging for hackers to guess or crack passwords through brute-force or dictionary attacks. Strong passwords are a formidable defense against unauthorized access, reducing the risk of account breaches and data compromise.

6. Set Up Suspicious Activity Alerts

Setting up suspicious activity alerts is a crucial security practice for eCommerce stores. These alerts automatically detect and notify administrators about unusual or potentially fraudulent activities in real time.

For example, if a single IP address repeatedly attempts multiple failed login attempts within a short timeframe, the system triggers an alert. This prompt notification enables swift investigation and action, helping to thwart potential security breaches, identify malicious activities like brute-force attacks, and protect customer accounts and sensitive data.

7. Layer Your Security

Layering security in an eCommerce store involves implementing multiple defensive measures to safeguard against diverse cyber threats. This approach combines tools like firewalls, intrusion detection systems (IDS), and web application firewalls (WAFs) to create a robust shield.

A Web Application Firewall like Cloudflare’s can intercept and block malicious traffic, protecting against DDoS attacks, SQL injection, and other common vulnerabilities. By deploying these layers, eCommerce businesses create a multi-tiered defense that enhances the resilience of their online operations.

8. Provide Security Training to Employees

Providing security training to employees in an eCommerce store is essential for protecting sensitive customer data. Such training involves educating staff on security protocols, privacy regulations, and potential risks of handling customer information.

Employees know the importance of not sharing sensitive data through insecure channels like unencrypted emails or unsecured communication platforms. They also learn to recognize and respond to threats such as phishing emails, which can lead to unauthorized access or data breaches.

By instilling a culture of security awareness and best practices, employees become valuable assets in safeguarding customer data and maintaining the integrity of the eCommerce platform.

9. Use Tracking Numbers for Orders

Tracking order numbers is essential to protect your eCommerce store from fraud. Customers can monitor the shipment’s progress and delivery status when they receive tracking numbers for their purchases.

This transparency makes it substantially harder for fraudsters to claim they never received their items falsely. When faced with concrete tracking information, merchants have evidence to refute such claims, reducing the likelihood of chargeback fraud.

Trusted carriers like FedEx and UPS offer tracking services, ensuring accurate and verifiable records of each shipment’s journey.

10. Regular Monitoring and Patching

Regular monitoring and patching are critical for maintaining the security of your eCommerce website. Monitoring involves actively watching for suspicious or unusual behavior on your site, such as unauthorized access attempts or unexpected data flows.

Promptly addressing these issues helps thwart potential threats. Additionally, keeping software up-to-date is essential. This includes web servers, content management systems (CMS) like WordPress, and third-party plugins.

Updates often contain fixes for known vulnerabilities, making it harder for attackers to exploit weaknesses. WordPress, for instance, regularly releases updates to enhance security and address potential risks.

By staying vigilant and applying patches, you can significantly reduce the risk of data breaches and other security incidents on your eCommerce platform.

How Can Customer Support and Trust Building Help Protect Your eCommerce Store?

Customer support and trust building is not only about addressing customer inquiries and resolving issues but also a critical component of your overall fraud mitigation strategy. How does it achieve that?

1. Fraud Detection and Reporting

Customers who have a high level of trust in your eCommerce store are more likely to report suspicious activities. If they notice any unusual transactions or signs of fraud, they will likely contact your customer support team promptly. This early detection can help prevent further fraudulent activities and minimize financial losses.

2. Prompt Response to Fraud Reports

When customers report potential fraud or security concerns, it’s essential to respond promptly. An efficient and responsive customer support team can investigate reported incidents quickly, taking necessary actions to prevent fraudulent transactions from being processed. This includes blocking suspicious accounts or transactions and notifying affected customers.

3. Educating Customers About Security

You can educate customers about best practices for online security through your customer support channels. This includes advising them to create strong passwords, recognize phishing attempts, and use secure payment methods. Informed customers are less likely to fall victim to common fraud schemes, ultimately reducing the overall risk of fraud on your platform.

4. Building Long-Term Customer Relationships

Trust-building efforts go beyond fraud prevention; they also contribute to customer loyalty. Customers who trust your eCommerce store are more likely to make repeat purchases. This long-term relationship with customers can translate into increased sales and a loyal customer base, which can be more resilient against fraud attempts.

5. Resolution of Fraud Cases

When fraud occurs, a responsive and effective customer support team can help affected customers navigate the resolution process.

This includes assisting them in reporting the fraud to their financial institutions and guiding them through the necessary steps to recover any lost funds. Providing this level of support can turn a negative experience into a positive one, strengthening trust in your brand.

Tools to Protect Your eCommerce Store from Fraud

These tools are designed to help eCommerce businesses protect themselves against various types of fraud. Some of the best ones in 2023 include:

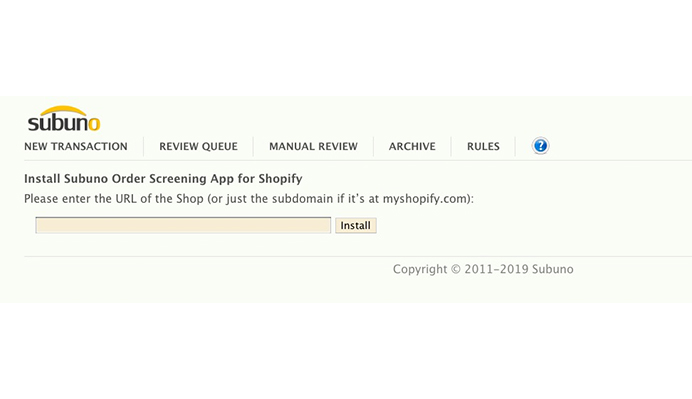

1. Subuno

Subuno is compatible with Magento, PrestaShop, Shopify, WooCommerce, and ZenCart, making it versatile for various eCommerce businesses.

It offers a subscription-based pricing model starting at $19 per month and a 30-day free trial. It boasts over 20 fraud detection tools to enhance eCommerce security. It offers geolocation tracking, data validation, and email address history checks.

The software’s algorithm can analyze over 100 risk factors for each order, helping businesses identify and mitigate fraudulent transactions. It provides an intuitive interface to review individual orders and use color-coded warnings to identify potential risks easily.

2. Riskified

Riskified is compatible with Magento and Shopify, making it suitable for these eCommerce platforms. The pricing depends on your transaction volume, and they do not offer a free plan or trial.

It utilizes advanced machine learning algorithms to provide real-time insights into transactions. It offers various analytical methods, including IP and geo-location tracking, proxy detection, social media analysis, order linking, device and browser fingerprinting, and chargeback fraud tools.

Instead of providing risk scores, Riskified simplifies decision-making by giving a clear “decline or approve” recommendation for each transaction. Businesses have the flexibility to review suspicious transactions manually. It charges fees only for approved orders that result in sales, which can be cost-effective for businesses.

3. FraudLabs Pro

FraudLabs Pro is compatible with several eCommerce platforms, including Magento, OpenCart, osCommerce, PrestaShop, Shopify, VirtueMart, WooCommerce, and ZenCart. It offers both free and paid plans. The paid plan is priced at $29.95 per month.

It provides a free plan with certain limitations. The free plan allows for up to 500 queries per month and offers various order validation variations. The software offers over 40 validation rules for effective eCommerce fraud screening.

Even with the free plan, users can access essential features like risk scoring, email notifications, a merchant reporting tool, and SMS validation credits.

Subscribing to a paid plan unlocks advanced features, including email validity checks, social profile queries, custom country checks, ISP usage checks, email domain age checks, high-risk username checks, and password checks.

Conclusion

Safeguarding your eCommerce store from fraud threats is vital for sustained success and brand reputation. In the digital age, convenience for consumers has attracted sophisticated cybercriminals. Failing to protect your eCommerce store leads to financial losses and eroded trust.

To fortify your eCommerce, choose a secure platform like Shopify or WooCommerce. Ensure secure connections and comply with PCI DSS standards.

Minimize data storage and implement measures like AVS and CVV verification. Enforce strong password policies and set up suspicious activity alerts. Layer security with firewalls, IDS, and WAFs. Educate employees on security and privacy.

Utilize tracking numbers for orders and regularly monitor and patch your site. Prioritize customer support and trust-building efforts for fraud detection. Invest in fraud prevention tools like Subuno, Riskified, and FraudLabs Pro.

In the dynamic eCommerce landscape, proactive security is necessary, not a luxury. Implement these strategies and tools to secure your eCommerce store, ensuring long-term success in the digital realm.

Acowebs are the developers of the WooCommerce PDF Invoices and Packing Slips generate PDF invoices automatically and add them to the confirmation emails sent to your customers. We also have developed applications like Email Customizer and Designer For WooCommerce that helps you build and customize WooCommerce emails with a drag-and-drop user interface.

Login

Login

Cart

Cart